Globalisation is transforming cities. Since the 1980s, private owners, developers and investors have played an instrumental role in defi ning urban transformation projects in London. The capital has a concentration of examples of this partner-led, negotiated urbanism, where the private sector is in a dominant position. Against this background, can the real estate offer still meet local needs in London or in other global cities?

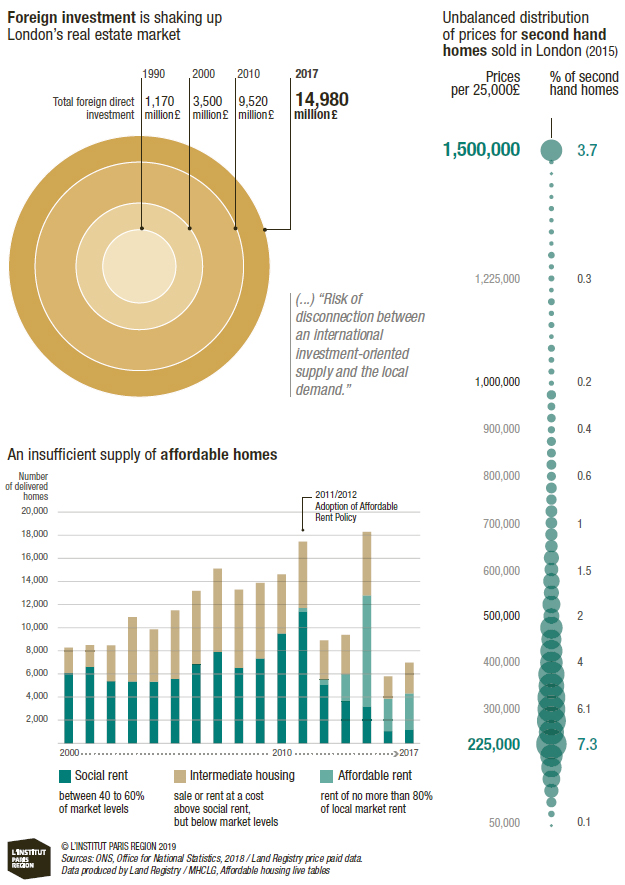

After a period of stagnation during the credit crisis, which significantly affected property markets from 2010 onwards, London experienced a new construction boom. In marked contrast to the tall buildings built in the 1980s and 1990s, skyscraper projects are no longer restricted to office developments. Residential towers are transforming the London skyline, whose height had not grown significantly since the post-war modernist era. Very high-end developments, true vertical villages, testify as much to the integration of the city into globalised financing flows as to its social and spatial fragmentation. Property investment is primarily focused on a selected geographical area, the business district of the City and its immediate surroundings, where property regulations are less stringent than in Westminster. Urban projects are also concentrated around transport hubs, on the banks of the Thames, and in regeneration areas. From 1980 to 2000, the most spectacular buildings were built and occupied by major financial services firms. Most of the City’s towers built over the last ten years, however, have been built speculatively, designed for the leasing market and destined for resale in the relatively short term. Recent transactions also reflect a change in the investment landscape. Whereas before a broad array of pension funds, insurance firms and Real Estate Investment Trusts took part in major transactions, more recently these have been carried out by a handful of firms with extraordinary financial capacities. The liquidity of the London office market is thus on the wane, to the benefit of a few institutional investors who occupy positions of dominance. Concerns are starting to be raised about the risk of a disconnect between an offer turned towards international investors and local demand.

The profit margins of "XXL" public-private partnerships

In “regeneration areas”, in other words post-industrial areas and/or districts with a large proportion of social housing around the edge of the historic centre of London, a new form of partner- led urbanism is emerging. It governs the development of urban areas whose size varies from about 20 to about 100 hectares. Land ownership is sometimes mainly public (Royal Docks), but most often it is split between a few large private owners (Greenwich, Nine Elms). Public-private consortiums, which make use of development agreements, act as developers. In all cases there is a trend towards huge building schemes, a sharp increase in density, and a privatisation of public space. Development projects whose land belongs to Greater London are run by a lead-developer following a call for tender, in compliance with EU regulations. There are no public development bodies as in France. These projects are coordinated by a single private developer (Kings Cross), or by a public-private partnership with relatively little capacity for action (Vauxhall Nine Elms Battersea). The lead-developer also coordinates ground decontamination operations and acts as a financial trustee. They might be responsible for defining the size of the blocks, the layout of interior circulation areas, the design and development of areas of public use, and the building of community facilities. They coordinate and commission preliminary surveys, environmental surveys, and impact surveys, organise consultations, and define modes of use in accordance with property market trends. Outline permission for “XXL” urban projects makes it possible to obtain planning permission for a large site based on a detailed presentation of a sample of the project, providing considerable flexibility in terms of redefining the size and uses of blocks, whose ultimate purpose is established incrementally. In these projects, councils support the lead-developer- coordinator more than they provide directives. For the Nine Elms – Battersea area, for example, a construction and landscaping charter has been drawn up by borough councils, but with no guarantee that its recommendations will be followed. In 2010, in its analysis of the project, the Design Council noted the risk of insufficient sunlight in the lowest-level housing units and recommended that the evolution of the site should be closely monitored, while observing that public authorities lacked the necessary tools to influence the ultimate form of the development. Following local government reforms introduced during the Thatcher era and reinforced by David Cameron, councils have limited investment capacity, even if it is now possible for them to retain profits from the sale of properties it owns (capital receipts). In this highly restrictive context, only partnerships with private actors make it possible to make investments, but this in turn limits their control over urban projects.

The housing crisis: how can the goals of the 2019 London plan be achieved?

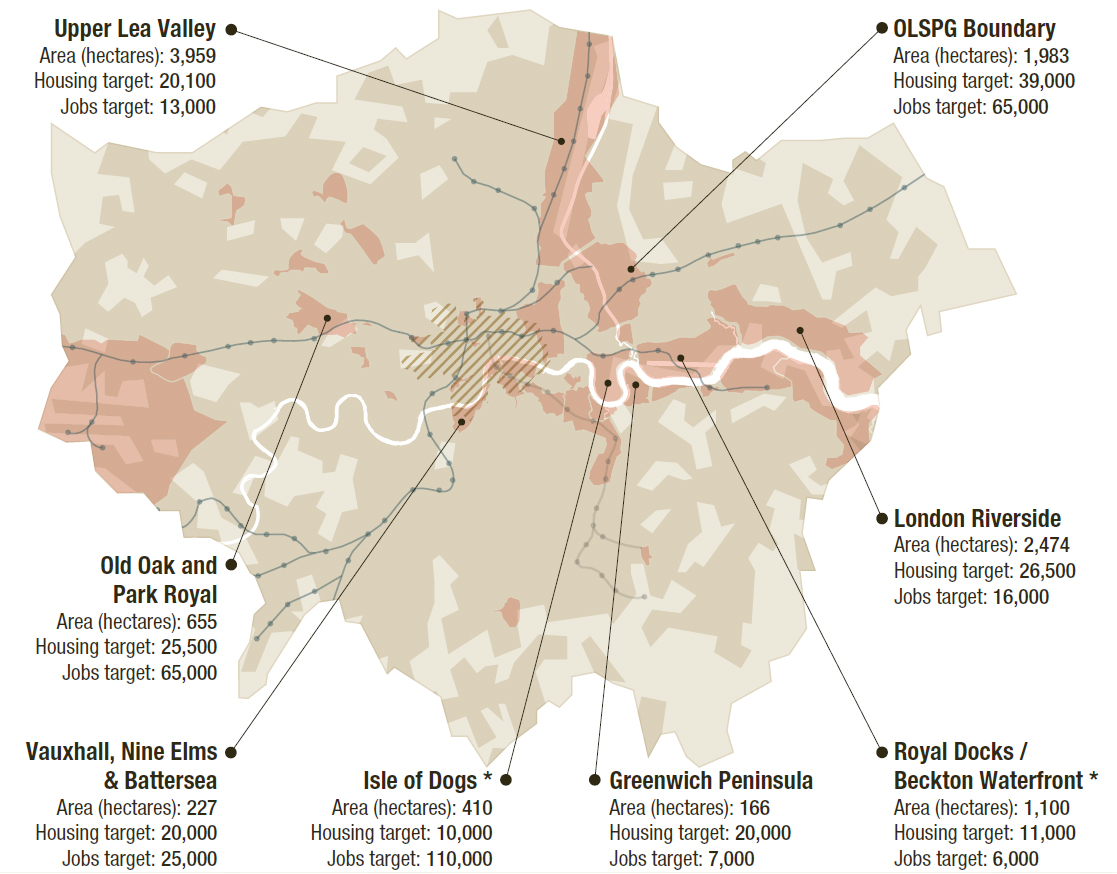

Strong population growth and the rising property values make it necessary to adjust available housing to Londoners’ needs. In some residential districts where property prices have risen particularly sharply, the number of transactions has fallen significantly because few buyers can afford the corresponding mortgages. The private residential market thus has a rather unusual structure: properties valued at over £1.5 million are almost being overproduced, while the intermediate sector, which makes significant losses, increases pressure on properties in the lower third of the market. Owner-occupants under 45 are now a minority, and overcrowded housing is on the increase. Currently, only the shared ownership system offers the equivalent of very long-term leases with guaranteed rent control. Occupants purchase shares in their homes from a housing association and pay rent on top. Rent increases are capped, as well as the profit made from reselling householder shares. Although it only applies in a minority of cases, this system is on the increase in regeneration projects, raising the risk of replacing social housing with accommodation targeting better-off households. To influence the production of housing, the Mayor has three sets of tools at his disposal. First of all, he can provide financial support to developers. Sadiq Khan announced the creation of an investment fund for the period 2016-2021, the London Investment Programme, totalling £3.15 billion. Subsidies ranging from £28,000 to £60,000 are available for the construction of housing that fits one of the affordable housing categories. The Mayor can also speed up planning permission procedures. He has direct responsibility for examining projects including over 150 housing units. Under the Khan administration, projects offering at least 35% social or intermediate housing are exempt from viability assessment, a rather time-consuming preliminary financial assessment process. The third area of intervention concerns the mobilisation of land resources. The Greater London Authority (GLA) has a land portfolio of 635 hectares, inherited from the decentralisation of State-owned land and belonging in part to Transport for London (TfL). Although this represents a significant asset for an authority that initially possessed scant resources, this portfolio seems modest in comparison with other large cities. To mobilise these assets in favour of affordable housing, the administration once again has various tools at its disposal: it can offer a reduced price for land sold by TfL; or it can redevelop the land with commercial partners via the London Development Panel, a group of developers set up by the GLA. “English-style” negotiated urbanism is often praised for its flexibility and its ability to adapt to changing economic circumstances. The strong involvement of private actors, from the design phase to the project management phase, is another feature of contemporary globalised urbanism. But the fact that local authorities have such a narrow margin for manoeuvre runs the risk of sharpening territorial divides in the capital. The long-term public interest is not the primary concern of private investors. As a major source of brownfield land, London’s Opportunity Areas are identified in the London Plan as areas having a large capacity for urban development. They are earmarked for future housing or commercial use and have existing or potentially improved public transport access. Along with other supporting facilities and infrastructure, each area can accommodate at least 5,000 jobs, 2,500 new homes or a combination of the two. The Mayor of London works closely with the boroughs and other stakeholders in developing Opportunity Areas, as he provides encouragement, support and leadership in preparing and implementing Planning Frameworks, which serve to help realise the potential of these areas. Planning regulations are light with a priority on development over preservation of the existing urban fabrics and heritage buildings. Conflicts between the developers, the borough councils and the Mayor do arise in the planning process.

Martine Drozdz, Researcher, French National Centre for Scientific Research (CNRS), Laboratoire Techniques Territoires Sociétés

FURTHER READING

“We Work Turn Heads In Rapid March Across London”, Financial Times, Evans Judith, 22/07/2017.

“Change in central London buyers mix spurs liquidity drop”, Real Capital Analytics, 12/03/2018 leahy tom.

“London’s Growing Up!”, New London Architecture Insight Study , 120p.