The Île-de-France hydrogen industrial sector at the crossroads

Renewable and low-carbon hydrogen could play an important role in the decarbonation of our life-styles, provided that its most relevant uses are identified. Their development requires that of production, refueling and storage installations. Beyond possible and already existing applications, île-de-france has a hydrogen industrial value chain able to partially supply these facilities. Who are these actors, what is their specialty and what are the outlooks for the sector in Île-de-France?

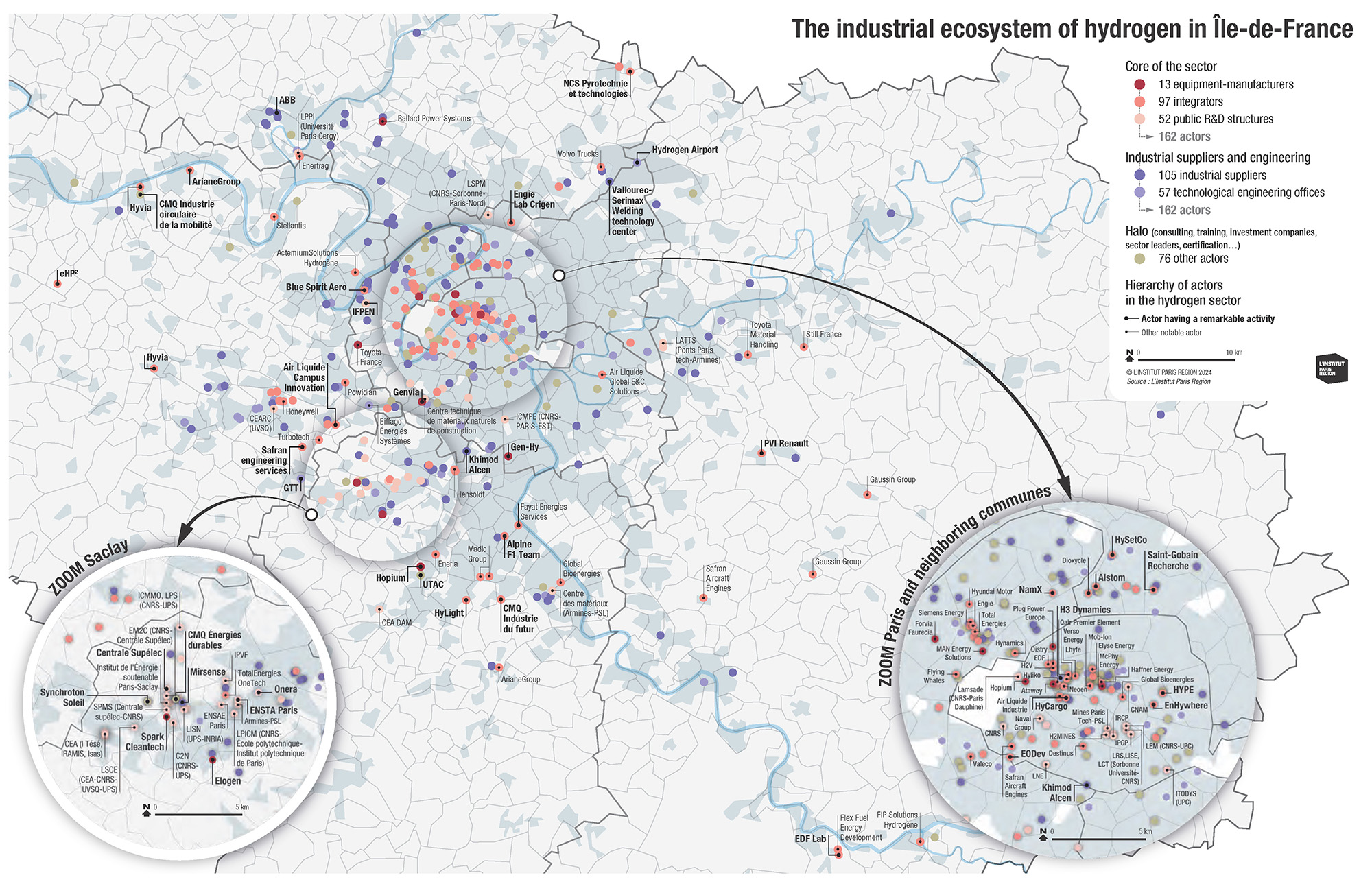

Hydrogen is indispensable to the carbon neutrality of several sectors, according to the International Energy Agency. Its place, the volumes required or the types of uses vary according to the scenarios. In the refinery and fertilizer industry, the current consumption of hydrogen, produced for the most part from fossil fuels, must be decarbonized. New uses linked to mobilities (land, river, sea and air), industry (steel…) or energy (energy production and renewable energy storage or backup supply) are developing, favoring a renewable and low-carbon hydrogen. In Île-de-France, there are 400 entities in the hydrogen industrial sector, positioned throughout the entire value chain (production, transport, storage, distribution and uses). About 40% of them are at the core of the sector (hydrogen equipment-manufacturers, integrators and public research), which is based on an ecosystem of industrial suppliers or engineering offices, representing nearly 160 entities, or also about 40% of the total. The remaining 20% are comprised of diverse actors with, in first place, engineering structures. For the majority of these actors, hydrogen is only one of their markets – often a secondary one – which is why it isn’t possible to estimate the total number of jobs in the sector. According to our estimates, the 53 hydrogen specialists (pure players), half of which are start-ups specifically created based on these technologies, employ 1,400 highly qualified people.1

EQUIPMENT-MANUFACTURERS, INTEGRATORS AND RESEARCH AT THE CORE OF THE SECTOR

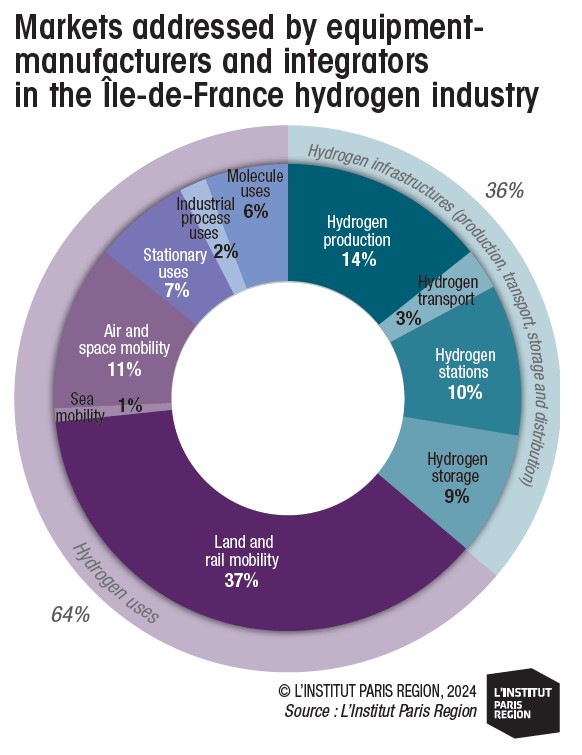

At the core of the hydrogen industrial sector are a dozen or so equipment-manufacturers that design or produce equipment specific to the hydrogen technology – primarily start-ups specialized in hydrogen. They work on critical aspects of H2 technology, such as membranes (Gen-Hy), electrolyzers (Elogen, Gen-Hy, Genvia with is high-temperature electrolyzers and the French company McPhy Energy) or fuel cells (Plug Power, Toyota and Hopium). Plug Power and Elogen have developed an industrial capacity in Île-de-France. The former created a joint venture with Renault (Hyvia) for assembling fuel cells at Renault’s ReFactory in Flins, and integration in Renault Master. Elogen designs and assembles PEM electrolyzers in Les Ulis. As for Gen-Hy, Genvia and Hopium, they have developed R&D activities. The integrators design, develop and manufacture products and solutions incorporating a hydrogen technology. For most of them, hydrogen is only one market among others. They represent nearly 100 entities stemming from large groups with their head offices and R&D activities concentrated in Île-de-France, but also smaller companies and many start-ups. Some are builders, in the same way as mobility industrialists, like the automobile, which work on fuel cell or direct combustion vehicles (Renault and Stellantis, as well as new actors like NamX). There are also air and space enterprises (Safran Moteurs and Arianegroup, and the Turbotech, HyLight and EHP2 start-ups) that design hydrogen-powered engines using direct combustion or fuel cells for the Flying Whale airships and the railroad sector (Alstom). There are also manufacturers of worksite equipment and forklift trucks (Still France), hydrogen refueling stations (Enhywhere) and generators (Powidian and EODev, which is building its assembly plant in Antony, supported by the France 2030 investment plan, in the framework of the “Première Usine” invitation to tender). Other integrators design, test or apply the technologies without manufacturing them themselves. This is the case of energy operators like TotalEnergies in its Onetech research center in Palaiseau, Engie in the Lab Crigen in Stains, the IFPEN in Rueil-Malmaison, EDF Lab in Les Renadières, Saint-Gobain Research in Aubervilliers and GRTgaz and its R&D center Rice, specialized in the transformation of gas infrastructures (with the FenHyx experimentation platform in Alfortville, supported by the Région Île-de- France). There are also, in this category, developers of production sites and hydrogen refueling stations (Hynamics, Lhyfe, HysetCo…). Two thirds of these equipment-manufacturers and integrators address markets involving hydrogen uses, while one third focus on hydrogen infrastructure equipment. Land mobility is, by far, the leading market (trucks, special machines, light utility vehicles, taxis, trains…), then hydrogen production and its distribution (H2 stations) as well as storage applications. Next come air mobility (H2 combustion engines, drones, airships…) and stationary applications (generators, hydrogen-powered turbines…). Île-de-France concentrates 42% of French researchers, 3 with 52 active public research structures focused on hydrogen. We can cite the ONERA, in aeronautics and space, the IFPEN, in motorizations and natural hydrogen, the CEA (French Atomic Energy Commission) and the Naval group. The CNRS (French National Scientific Research Center) is a partner of many research teams that have come out of prestigious engineering schools such as Polytechnique, Centrale Supélec, Chimie Paris Tech… and universities like Paris Cité, Cergy Paris, Paris-Saclay, among others. Strong competencies in Île-de-France in the safety and materials field (CEA, starting with the nuclear sector) can be noted. Materials are also a major theme for engineering schools (Mines, Chimie Paris Tech…) and academic research institutes such as the Institut de chimie et des matériaux de Paris Est, and the Institut de chimie moléculaire et des matériaux d’Orsay (ICMMO). The hydrogen sector benefits from competencies in power electronics and energy management/conversion at the Institut photovoltaïque d’Île-de-France, Centrale Supélec, the Université Paris-Diderot and others. Moreover, the ENSTA Paris, member of the Institut Carnot MINES, houses a hydrogen pilot platform that makes it possible to conduct tests on hydrogen production and combustion, and looks for alternatives to very low-temperature storage. Lastly, the Soleil synchrotron, located on the Saclay plateau, enables experiments and in-depth tests to be carried out, in particular on matter.

OTHER ACTORS INDISPENSABLE TO THE SECTOR GRAVITATE AROUND ITS CORE

A second circle of actors is comprised of engineering offices and industrial suppliers with some 160 firms. The former take part in the sector’s development, supporting the design of equipment, in technological development in the form of periodic contracts, but also through long-term relationships with their contracting parties. Some are specialized (Hinicio), while others have focused their activity on the development of IT solutions to optimize supplying hydrogen (FillnDrive and Hyjack). The equipment-manufacturers and integrators rely on numerous industrial suppliers in Île-de-France. They design, supply, even produce, in the region, elements that are not specific to hydrogen, but required for these systems’ operation. They are specialists in pipework, compressors, pumps or valves, flexible pipes or metal tubes (a notable example is the Vallourec-Serimax world welding center in Paris Nord II), plastics processes (airtight systems or technical parts such as Plastic Omnium’s tanks), scientific and technical instrumentation (measurement and regulation solutions, sensors…), instrumentation and control systems (the leader being the Swedish company ABB and its world robotics center in Cergy), materials (such as Arkema, which offers tank envelope solutions or membranes for fuel cells), etc. A third circle is formed by about 80 very diverse actors, mainly consulting firms that constitute two thirds of this group. There are also six investment companies that support start-ups, including the Demeter and Kouros funds, as well as Hy24, specialized in hydrogen,4 other actors in training, including three campuses focused on qualifications and professions, as well as the IFP School. There are pipeline transport specialists such as Trapil, and those in geological storage. Five structures take part in the leadership of the hydrogen sector, the first of which being France Hydrogène in Paris, but also the Club hydrogène Île-de-France, led by the Agence régionale énergie climat (AREC îdF), a department of the Institut Paris Region. The Nextmove automobile and the Astech aeronautic competitivity hubs and the Starburst incubator, dedicated to aeronautics, which houses the engine-maker Safran’s explore H2 program, also hold a leadership role. Lastly, the gas production and distribution actors and all the users have know-how and competencies in hydrogen that can be transferred to the entire value chain.

WHAT OUTLOOKS FOR THE HYDROGEN SECTOR IN ÎLE-DE-FRANCE?

The development of the hydrogen sector faces various challenges, the first of which is its technical and economic feasibility compared with possible alternatives according to the uses envisaged. After great initial enthusiasm, a return to reality can be observed, strengthened by rapid progress in battery technology. This could put an end to certain hydrogen uses in land mobilities, and due to the difficulty in implementing hydrogen production, in particular, for large-scale electrolyzer projects. The region has developed low-capacity (< 10 MW) production sites whose purpose is to supply refueling stations, while massive production sites (> 100 MW) are located along the Seine’s estuary, from Le Havre to Rouen, for use in heavy industry and synthetic fuels.5 The presence of many actors in research, large groups and start-ups, in the same way as the size of its market are major assets for Île-de-France. Consequently, even for niche uses, the region remains an interesting place for developing this activity, and can serve as an experimentation territory and business model test for start-ups. Several tests underway (the first H2 taxi fleet in Europe, generators, construction site machines, forklift trucks, barges…) or occasionally major events, like the Olympics and Paralympics in Paris in 2024, bear witness to the unique place held by the capital region.

The creation of the low-emission zone (ZFE) and the Clean Vehicles Directive are accelerating a renewal of automobiles, in particular, those for professional use. Light utility vehicles are strongly impacted, with a small part that will be powered by hydrogen.

Likewise, concerning trucks, if the battery is increasingly prevailing over hydrogen some uses remain relevant and should offer a large enough mass market for industrial actors to position themselves on it. A hydrogen refueling station infrastructure dedicated to trucks is already fulfilling the potential demand (Hyliko in Villabé, the TEAL joint venture located along European corridors, Engie in Tremblay-en-France, Distry in Bonneuil-sur-Marne and Montereau…).6 These hydrogen uses are encouraging the development of maintenance centers for vehicles (Hysetco in Saint-Denis, B. E Green in Buc, Stellantis in Carrières-sous-Poissy, Hyliko in Villabé…).

Hydrogen can also be relevant in the framework of the intensive use of special machines and forklift trucks. Île-de-France, with its enormous consumer market and its plethora of warehouses, is also an exchange platform, with its ports and airports. As a result, Aéroports de Paris (ADP) wishes to develop the use of fleets of captive hydrogen vehicles to decarbonate air transport. In the same way, a first cold storage warehouse has just been equipped with hydrogen forklifts in Athis-Mons. Finally, as for decarbonation of the industry, Île-de-France is a market with, certainly, very few possible large sites, but one that has several mid-size sites linked to smelting plants, microelectronics and glasswork in particular. Only two large industrial sites, the Grandpuits refinery and the neighboring fertilizer producer envisage their conversion and decarbonation through the use, even the production, of hydrogen.

Île-de-France, a constantly evolving territory, generates construction sites whose machines could use hydrogen, via a fuel cell or a combustion engine. It lastly hosts many temporary events, notably cultural (festivals, shootings, concerts…) or sports events, for which hydrogen generators can be a relevant solution.

Île-de-France is nevertheless facing constraints that are curbs on the development of the hydrogen sector. The lack of available and affordable industrial land has led several hydrogen start-ups to leave the region in their industrial phase, like Elogen (Vendôme), Hopium (Saint-Bonnet-de-Mure), NamX (Morocco) and Gen-Hy (Montbéliard) for example. Moreover, the growth of increasingly large data centers creates competition on certain sites for access to electrical power on the transport network for electro-intensive industries7 or the development of massive hydrogen production by electrolysis.

The competition of other regions, including the rest of France, on this technology is fierce. Île-de- France would benefit from highlighting its rich ecosystem of industrial suppliers, which is not perceived at its true value by investors, with the result that fewer new plants are built. Land remains a major constraint even if it is the center of attention. Finally, as elsewhere in France, the subject arises of a lack of manpower with specific skills that hydrogen requires at the level of workers, engineers and technical sales representatives and, increasingly, maintenance workers.

ACTORS THAT WANT MORE TARGETED ACTION

The sector’s actors want strengthened support from the public administrations as the technologies – and therefore the markets – have matured to various degrees, in the qualification phase of the case of use and potential buyers’ wait-and-see attitude. Some point out the necessity of reinforcing standards concerning the environment and CO2 emissions to ensure a market for these technologies. Public procurement can also play a support role. Industrial actors are calling for more support for production – notably electrolyzers and fuel cells – on the European continent to compete with countries undergoing strong development such as China8, India and the United States, whose market is difficult to access. Finally, the actors bring up the interest in developing a regional, even inter-regional, shared and multi-sectorial reflection, with as the key a roadmap providing visibility to investors for planning production, transport, storage and distribution sites, and targeting the relevant cases of use.■

____

1. In the 2023 barometer of hydrogen development in France, the association France Hydrogène estimated that the French sector represented 6,400 direct jobs in 2023, a figure in constant growth since 2021.

2. That will become Hypertech Alpine in 2025 and will be the group’s F1 engineering center.

3. Source: MESRI-SHES, 2020 figures.

4. In April 2024, HysetCo, a major actor in hydrogen stations and vehicles in France and Île-de-France, announced €200 million in funds raised from an investors group piloted by Hy24, to accelerate the rollout of its integrated hydrogen mobility solutions and to decarbonate urban transport.

5. These synthetic fuels, made from CO2 and hydrogen, would be transported through the existing petroleum products pipelines to supply airports in the Paris region.

6. The AREC, through the Club Hydrogène Île-de-France, annually publishes a map of existing and planned hydrogen production sites and distribution stations in Île-de-France.

7. “Electro-intensive” industries are those whose activity requires major electricity consumption, such as the steel, glass, cement, metalworking, chemical and cardboard industries.

8. The 2024 Global Hydrogen Review of the International Energy Agency points out that China has strengthened its worldwide leadership, with over 40% of final investment decisions for hydrogen production and 60% of the global electrolyzer manufacturing capacity. The continuous expansion of its production capacity should lower the cost, as has been the case for solar panels and batteries.

TWO FLAGSHIP TECHNOLOGIES FOR HYDROGEN

The principal technologies are the production of hydrogen by electrolysis of water (PEM, AEM, alkaline and SOEC technologies), hydrogen transport and storage (pipelines, hydrogen carrier molecules, compressed hydrogen tanks and liquefaction), distribution (stations) and uses linked to land or air mobilities (fuel cell, combustion engine and synthetic fuels) in particular.

Electrolysis of water, notably alkaline, is an early, marketed and mastered technology. PEM (proton exchange membrane), AEM (anion exchange membrane) and SOEC (solid oxide electrolyzer cell) technologies are still being developed and are in the process of industrialization in order to have the best energy efficiency and the fewest needs in materials.

Fuel cells

The opposite of the electrolysis reaction, they are still expensive because they are produced in low volumes and require costly materials (platinoids). The development of the first fuel cell plants (Symbio in Saint-Fons, Hyvia in Flins, Inocel in Belfort and Toyota in Belgium) should make it possible to reduce costs, in partnership with integrators for the deployment of mobility (like Stellantis with the Symbio cell, and BMW Group, Hyliko and EODev with the Toyota cell, used in several applications). Over the last few years, we have witnessed a renewal of the internal combustion engine directly burning hydrogen. For this technology, we are expecting, in the end, efficiency as great as 50%, for lower investments than for a fuel cell. Like the BWT Alpine F1 Team in Viry-Châtillon2 and the IFPEN in Rueil-Malmaison, historic and new actors are positioning themselves on this technology, based on the resources and R&D of the automobile sector in Île-de-France.

THE RÉGION ÎLE-DE-FRANCE SUPPORT ACTIONS

The Région Île-de-France incorporated the development of renewable low-carbon hydrogen in its Stratégie énergie-climat in 2018, then adopted a hydrogen strategy in 2019. This strategy led to the creation of the Club Hydrogène Île-de-France, run by the AREC îdF. Two plans that support hydrogen production by electrolysis (up to €2 million) and refueling stations (up to €400,000) were put in place. Included in the Plan air, the assistance plan for clean vehicles was opened for hydrogen-powered light utility vehicles and trucks (up to €30,000) for very small and small and mid-size enterprises, craftsmen and small administrations. As a result of a tight budget situation, the Région Île-de-France announced that it had suspended these aid packages in 2025. These investments could be restarted if additional revenues are voted. The Région has incorporated hydrogen as a strategic technology in its economic development strategy “Impact 2028.” Support plans concerning R&D, experimentation, industrialization and decarbonation of the industry back the actors. The incubator Le Perqo houses two pure players, EnHywhere and HyCargo. Hydrogen is also included in the Île-de-France master plan (SDRIF-E) to contribute to the growth of renewable energies and reindustrialization. SEM IDF Investissements et territoires as well as its subsidiary IDF Énergie et territoires have incorporated hydrogen into their objectives in order to support the search for land for its hydrogen manufacturing or production/refueling sites. Lastly, Île-de-France Mobilités, after an initial experimentation with buses in Versailles, has gotten involved in hydrogen territorial ecosystems (H2 Créteil and Vallée Sud Hydrogène) to acquire 47 buses.

This study is linked to the following themes :

Economy |

Environment |

Mobility