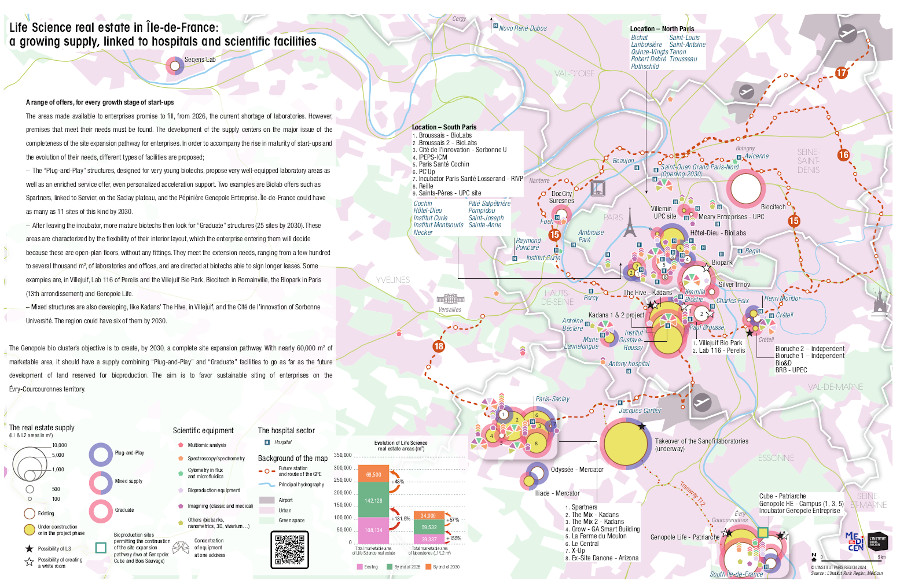

Life science real estate in Île-de-France: a growing supply, linked to hospital and scientific facilities

Biotechnologies in the health sector are strategic technologies: keeping control of production processes and sites is both an issue of sovereignty, an issue of sustainability for the healthcare system and an economic issue, because the products and services generated have very high added value. Their rapid development notably requires the availability of specialized real estate, which is very hard for small enterprises in the paris region to access. Whereas tensions on this very specialized segment of the real estate market are at the strongest level, life science real estate developers are now putting non-negligible areas on the market. The Institut Paris Region and Medicen have drawn up a panorama of the supply of facilities slated to accompany the growth of biotechs.

The number one problem of French start-ups is to find financing. However, in Île-de-France, there is another one: having access to laboratories. Small biotech enterprises have been sounding the alarm for the last several years on their difficulties in accessing real estate equipped with L1 and L2 (wet lab)1 laboratories in the region. They have had to find makeshift solutions to continue their growth, and some of them were forced to relocate their activities outside the Paris region. This situation, fraught for a year of two, is in the process of changing, with a host of construction projects underway and others concerned with restructuring existing buildings. All the difficulties of this emerging market have not however disappeared. The interviews conducted in the framework of this study (read box p. 6) have made it possible to uncover reflection tracks for the consolidation of the ecosystem – Life Science enterprises and real estate.

TOWARD A DOUBLING OF THE SUPPLY IN 2026 AND A POTENTIAL TRIPLING BY 2030

Île-de-France is undergoing major development today of its Life Science real estate supply. The existing marketable area (L1 and L2-type laboratories, associated offices and shared spaces included), which amounts to about 108,000 m2, should more than double by the end of 2026 to reach 250,000 m2 then exceed 300,000 m2 by 2030. As for the areas of the laboratories alone, 50,000 to 60,000 m2 should be added to the existing 40,000 m2 at the end of 2026 (see map). The areas and the collated schedules are what has been declared, but certain projects are already starting, and the figures for 2026 can be considered solid, except for unforeseen events. As for later projects, around 2030, their delivery will depend on the rhythm of the marketing of areas previously put on the market.

A SUPPLY LINKED TO HOSPITAL AND SCIENTIFIC FACILITIES

The combined reading of the laboratory real estate supply and public transportation serving this region – including the Grand Paris Express network – associated with hospitals and technical platforms, makes it possible to understand the Paris region supply with all the development potential that it proposes to enterprises. Some sites seem extremely interesting for start-ups. The proximity of hospitals that have a recognized activity in clinical and pre-clinical research, about 40 facilities, is essential. Access to the technical platforms open to enterprises2 – through transaction – is also indispensable to research conducted by start-ups. Over 350 platforms have been inventoried. Île-de-France is in the process of acquiring an asset that was lacking in its biotechnology ecosystem: a Life Science real estate supply linked to the hospital and scientific facilities in the “15-minute city.”3

THE CURRENT REINFORCEMENT IS MORE BENEFICIAL TO THE SOUTH OF ÎLE-DE-FRANCE

Three departments, Essonne, Val-de-Marne and Paris, concentrate the existing and potential supply with 39 sites out of the 42 inventoried, and over 90% of the supply presented by 2030, 290,000 m2 of laboratory/office area. More precisely, the real estate supply is being reinforced almost exclusively on four territories: Paris-Saclay Cancer Cluster (PSCC), in Villejuif, the Saclay plateau, Genopole and the southern half of Paris. In Villejuif, the Kadans Science Partner buildings, with The Hive now being built, will initially increase the marketable area by 25,000 m2. Over 30,000 m2 of additional area are envisaged by 2030. On the Saclay plateau, the accumulated potential supply is estimated at more than 50,000 m2, with the arrival of The Mix (15,000 m2) then The Mix 2 (10,000 m2), Kadans, Le Central (16,000 m2), run by the Paris-Saclay public development agency (EPA), and the Grow by GA (3,550 m2) building. We can also note the rehabilitation project of the former Danone site (8,000 m2) of the investor Arizona. On the Évry-Courcouronnes territory, Genopole Life, of Patriarche (21,000 m2), and Cube (10,000 m2 dedicated to bioproduction) aim at completing the biocluster’s existing supply with, by 2030, a supply combining facilities of different types depending on the maturity of the enterprises, to go as far as the future development of land reserved for bioproduction (Bois Sauvage). The objective is to favor the sustainable siting of enterprises on this territory. Finally, despite the tensions specific to the Paris region, the supply continues to expand, particularly in the southern part of the capital, with the Cité de l’innovation Sorbonne Université (7,300 m2), Biolabs at Broussais (1,000 m2) and Hôtel Dieu (10,500 m2), as well as the future incubator Paris Santé Losserand (5,000 m2), opposite the Saint-Joseph hospital. These projects will add 24,000 m2 to the current supply, estimated at 22,000 m2. The supply is also being enriched in Créteil, with the Mondor Institute for Biomedical Research (IMRB). The transportation network (metro line 7 and the future line 15), connecting Villejuif to Créteil, is proving crucial for the development of this emerging ecosystem, which wishes to incorporate itself into the innovation fabric of metropolitan healthcare and to complete the oncology area of the PSCC. No notable evolution of areas is planned over the next few years in the departments of the Yvelines, Hauts-de-Seine and Seine-Saint-Denis, which remain for the moment relatively at the margin of Life Science real estate. The exception is Seqen’s Lab, in Porcheville, which proposes 1,000 m2 of laboratories and offices, and has other capacities if needed.

THE DEVELOPMENT OF A RECYCLING SUPPLY

Although most of the laboratories arriving on the market are new, some of them are in converted buildings,4 such as the Odyssée in Les Ulis. In Suresnes, Doc City, which opened nearly a year ago and proposes areas to start-ups alongside the medical consultation hub, is located in a renovated office building that previous belonged to Saint-Gobain. The role of actors such as Oxford Properties, allied with Novaxia for the takeover of Biocitech in Romainville, and Arizona, for the former Danone site, potentially has an impact on the territories concerned, because the areas that are being readied for the market are significant. With its 24,000 m2 and 3.5 ha of land, Biocitech remains a site with strong potential, served by metro line 5.

INTERNATIONAL ACTORS SPECIALIZED IN LIFE SCIENCES

Most of the enterprises making an offer are in the private sector. Kadans, Patriarche and Biolabs are international actors that are specialized in Life Science real estate. Working in different European or North American clusters (London, Lausanne, Leiden, Heidelberg, Boston, North Carolina…), they are now interested in space in the Paris region, each one with its own positioning. To adjust their offers, they work in close collaboration with the principal territorial actors, whether they are local administrations and development structures (EPA Paris-Saclay, SEM Genopole…), hospitals (AP-HP and Gustave-Roussy) or, according to the case, large pharmaceutical companies (Servier, Sanofi…).

LOCAL PRIVATE ACTORS THAT CUSTOMIZE

Another category that is very interesting for the strategies created but concerning much smaller areas is that of local private actors that customize. A totally atypical example is that of the OxiProteomics biotech, a spinoff of the Université Pierre-et-Marie-Curie (UPMC), that not finding anything to expand, set up a société civile immobilière (SCI, a non-trading real estate investment company). It started building its own laboratories, providing space for itself at controlled costs and even offering the excess space to other companies. In a different register, the small family-owned real estate company Mercator, which, given its close proximity to the Saclay plateau ecosystem – both that of start-ups in the post-incubation stage and that of local real estate – was able to propose space to L1-L2 labs by transforming a building that had been empty for several years, in the Courtaboeuf park in Les Ulis. It is now developing its existing supply, Odyssée, on the adjacent land, by putting Iliade (1,600 m2), a new building that can house industrial pilots on the ground floor, on the market.

THE PUBLIC ACTORS SECTOR

The hospital and university sites (Sorbonne Université for the Cité de l’innovation, for example) are increasingly attempting to promote a supply open to outside enterprises. The case of Henri-Mondor demonstrates the interest of private sector stakeholders in the public sector: the university receives rents, the IMRB leases its technical platforms and the start-up tenants have access to a very high-quality research environment, at regulated prices. Another type of public actor is the SEM RIVP, which, unlike a classic public housing landlord, has created regulations giving it the possibility of diversifying its activities. It applies its social housing financing model to real estate intended for enterprises and lends over the very long term, with a profitability objective of 4 to 5% over 50 years. As in the housing market, this system makes it possible to keep Paris rents at levels below that of the market, which is regularly criticized. We can however consider that this subsidized real estate has the virtue of having enterprises emerge that, tomorrow, will need real estate developed by private actors. To be noted: the RIVP, because it puts public funds to work, must operate exclusively with an autonomous association, of the Paris Biotech Santé type. In addition, it can in no case go into partnership with a pharmaceutical company to run its incubators. The Life Science real estate actors are now interested in Île-de-France, but not all the difficulties on this emerging market, however, have been raised yet.

A MARKET DIFFICULT TO APPREHEND

The needs, in terms of area as well as equipment and services, are difficult to apprehend, according to many actors, all the more so as they are not specialists in this very specific type of real estate. Compared to tertiary real estate, it is a market that meets the needs of a small number of enterprises looking for small spaces, that have limited financial capacities but needs in laboratory equipment that are anything but limited. The areas required today would not be occupied by one or two large tenants, but by several small ones, bringing about major management costs. There is a lack of intermediaries, because brokers haven’t mastered this market. The spaces in play are modest, the clients very specialized and the supply very technical, whereas the financial profitability expected is less than for the traditional tertiary sector. Life Science specialists however have clearly identified Île-de-France as a territory suitable for this type of business. The interest, clearly understood by everyone, will be to estimate the enterprises’ needs, as best as possible, in terms of their financial capacities in order to limit marketing unadapted offers and getting dispose of the specter of oversupply. The selling rhythm of the first wave of offers, from now until 2026, will comprise important information for later marketing.

CONTRIBUTING TO THE ROBUSTNESS OF THE ECOSYSTEM

Faced with the difficulty in apprehending the evolution of biotechnology enterprises’ economic situation on one hand, faced with the production challenges of real estate that is adapted to needs but is the result of powerful financial logic on the other hand, what tracks could be envisaged to strengthen the Paris region ecosystem? It is first a question of ensuring the follow-up of the existing and planned real estate supply. The information provided by project initiators is indicative, even more so when the end dates are relatively far off: the schedules can slide, the areas can be revised and new projects can appear, while others are abandoned. This follow-up could help control the risk of oversupply and improve the supply’s readability. It next concerns formulating the question of the cost of facilities. The fact that this cost is very poorly estimated from enterprises that come out of public research centers and incubators is cited often enough by private as well as public actors to raise the alarm on the fragility of the economic models of start-ups if this subject is not better anticipated. Start-ups that are better informed about the cost of facilities will probably be in a better position to propose realistic financing plans.

COMBINING FLEXIBILITY, REVERSIBILITY AND SITE EXPANSION PATHWAYS

The evolution of spaces is not really compatible with the traditional existing supply, which requires the enterprises to undergo successive moves, combined with logistical costs and an impact on employee loyalty. The reversibility of spaces between laboratories and offices or the possibility of expanding its rental area on demand meets the expectations of enterprises and favors keeping them on the same site, which serves the interest of the enterprise, the landlord and local administrations. These aspirations can be on the scale of the building, in the case of real estate combining “Plug-and- Play” and “Graduate,” for example, like that of the territory.

THE PARIS REGION ECOSYSTEM IN THE GLOBAL LIFE SCIENCE MARKET

What is the dynamic of Île-de-France in the globalized Life Science market, a market moreover that is relatively emerging if we compare it to that of the office? In the British “Golden Triangle” (Cambridge, Oxford, London), as in Boston, large areas were recently put on the market or will be in the near future. In the context of properly steering this subject, essential for the economic health of the Paris region sector, it seems important to understand the situation of the capital region among the principal regional, even international, clusters. The shortage of laboratories that prevailed in Île-de-France is being reabsorbed; this is a fact that all the actors of the Life Science ecosystem can be pleased about. Furthermore, the situation has practically reversed itself: it is no longer the shortage that is regretted, but the risk of oversupply that must be monitored. Hence the importance of following the evolution of the situation in Île-de-France and in other metropolises around the world with which the region is in competition. Reflections for the development of Life Science real estate can be continued with an in-depth evaluation of environmental considerations (limitation of carbon emissions, no net land take objectives that aim at containing urban sprawl, etc.) or the implementation of the “productive city.” This is a city that favors keeping industry within the urban fabric, with a well-thought-out landscape, architectural and logistical insertion, and that facilitates access to labor with every qualification level. The question of estimating the potentialities offered by the conversion of the existing tertiary real estate, which can be obsolete or vacant, will also be raised.■

1. Research in biology requires handling carried out in laboratories (wet labs) that are classified in four confinement and security levels, according to the danger for human health of the biological material used: L1 corresponds to zero risk and L2 to a low risk (propagation very unlikely and existence of medical treatments). In L3 labs, pathogens for which propagation is possible are handled and treatments generally exist. L4 labs are very rare and none of them planned in the facilities concerned by this note.

2. Platforms that are therefore not exclusively open to academic research teams.

3. Theorized by the urbanist Carlos Moreno, the “15-minute city” is a city in which the inhabitants could access all their needs in a quarter of an hour.

4. More prospective, the redevelopment project of Val-de-Grâce, whose area corresponds to nearly three times that of Station F, is in the consultation process: although it is focused on the healthcare sector, the project initiators had still not, as of this writing, decided on the presence of L1/L2 laboratories intended for enterprises.

ABOUT 40 INTERVIEWS

About 40 interviews were conducted from March to June 2024 with developers, space managers, end users, local administrations and public actors, and structures capable of providing information on the scientific platforms accessible to enterprises. They made it possible to: - locate and quantify the existing and planned supply on the very specific segment of L1 and L2, and even L3, laboratories, along with everything that their operation is associated with (offices, laundries, refrigerators…); - characterize this supply (from the least equipped of the openfloor plan type, or “Graduate” to the “Plug-and-Play”, equipped with a high level of services and equipment that does not require any interior layout work by the enterprise that leases the space); - analyze the expectations of the actors concerned, the perceived market evolutions, as well as the territorial dynamics; - identify the points still missing in the analysis, the attention points and, when possible, recommendations.

This study is linked to the following theme :

Economy