How digital technology is disrupting mobility

Day-to-day multimodal mobility has been made possible by combining public transport with car-pooling, car-sharing, cycling, walking and even “urban gliding” such as overboard, etc. At the heart of this mobility revolution in the Paris Region are real-time access to information and digital platforms. The challenge now is to unify public and private data and make them work for even smarter regional mobility.

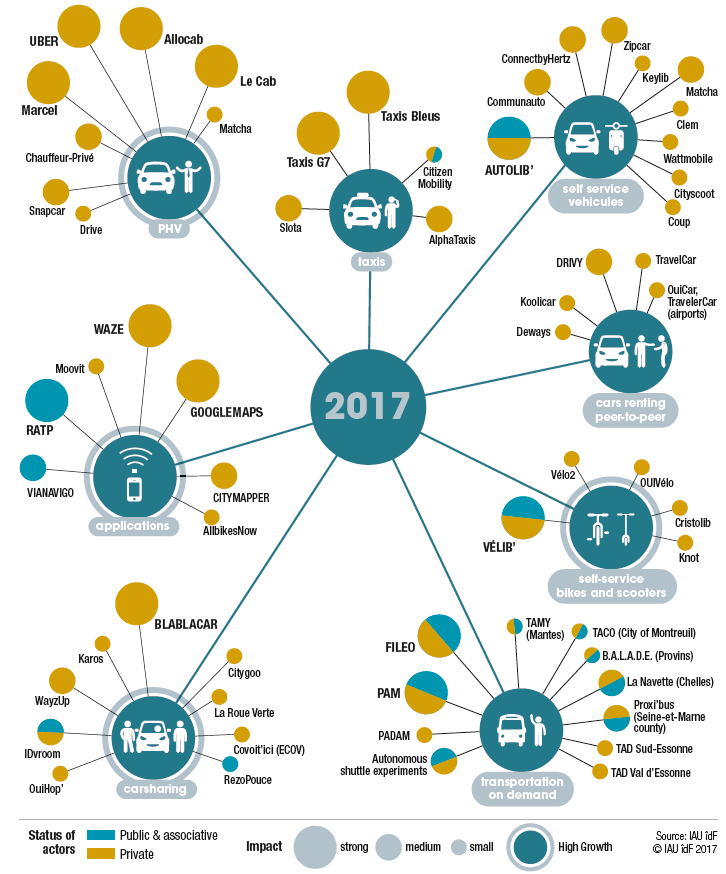

In addition to creating information applications, digital technology has boosted mobility services. However, for most private players, the market is far from being consolidated and remains immature regarding certain services. The establishment of a data governance system generated by all mobility applications would make it possible to organise more attractive and balanced mobility services across the whole region.

A new mobility tool: the smartphone

The smartphone is the new mobility tool. Whether you are walking, driving (GPS, car-pooling), looking for a bus route or the time of the next train or a self-service bike-sharing, the smartphone is your multimodal online/virtual accessible transport information station. As we move around, we are using our telephone more and more to obtain information, find our way and choose a route (today, 64% of French people check the state of traffic and transport before travelling, compared with 44% in 20141, a proportion which is even higher in the Paris Region where more people own smartphones). As the development of the smartphone increases, it is becoming an ever more efficient tool for information, assistance, booking and making payments. To begin with, multimodal route search applications open up endless possibilities by indicating the offers available and journey times. This information revolution has changed the image of transport modes, gradually reducing the opposition between private car users and public transport users. Indeed, digital technology compensates for the lack of information on mobility possibilities, but also instantaneously matches supply and demand. This disrupts all the “traditional” mobility sectors, including vehicle rental companies, taxis, vehicle manufacturers and, to a lesser extent, public transport providers... The taxi sector is the clearest case because its means of communication between customers/drivers renders obsolete the difference between a vehicle that has been pre-booked (private hire vehicle2 or taxi) and one that has not (a roaming taxi). Uber positions itself as a radical innovation by enabling drivers and their customers to get in touch with each other almost immediately, while providing unprecedented quality and ease of service, including payments, like BlablaCar. For all these public or private mobility applications, the Holy Grail is to become indispensable on a daily basis (i.e. to become a typical “toothbrush application”). By helping people to organise their trips, the smartphone gives each mode of transport its rightful place. It also helps reduce the use of the private car by making alternative transport offerings accessible.

A huge expansion in services

At the same time as the smartphone resulted in positive developments, digital-related innovations also generated the development of “physical” mobility services. Based on long-standing concepts3, car-sharing and car-pooling emerged against the background of skyrocketing oil prices and a growing awareness of the need to give priority to the protection of the environment. The Vélib bicycle-sharing and Autolib car-sharing schemes took off thanks to their public procurement contracts, which raised their profiles. They have since been riding the collaborative wave and the success of Blablacar. When, in 2009, the law established the equivalent of “remise” (private pick-up service), registrations of private hire vehicles began as early as in 2010, but these services really took off only in mid-2013, one year after the appearance of the UberX application. Like car-sharing among private individuals, private hire vehicles owe their success to a competitive advantage gained from cost savings on platforms. These services being still too recent and underused on a regional scale, they cannot be accurately evaluated today. However, targeted surveys of their users4 show some changes of behaviour and the users’ ability to call into question certain habitual modal choices according to the trips to be taken. But the main reason why people think twice about using car services (private hire vehicles, car-sharing, car-clubs etc.) is their cost, unlike car-owners who are keen to use their cars.

The issue of the territorial coverage of services

Apart from collaborative practices that network a whole area and concern all social groups, the services developed by operators are concentrated in densely populated areas where companies hope to break even5. For example, the ObSoCo observatory has noted that the frequency of use of chauffeured private hire vehicles varies from one to 10 depending on whether an inhabitant lives in Paris or in a rural municipality, given that four Parisians out of 10 had already used a chauffeured private hire vehicle in the past year6. The inhabitants of suburban and rural areas feel even more abandoned than before the emergence of these new offerings. The public authorities have been trying to address these imbalances by encouraging carpooling practices and supporting innovation. As they benefit from an ample supply of services, connected Parisians are potentially hypermobile and agile, even when they are non-motorised. But only a small section of the population enjoys such mobility. Having this range of modal options amounts to reserving scarce, and therefore precious, urban space and large expenditures of public money. Although spatial and air quality constraints may justify such expenditures in Paris, the issue facing the Paris Region decision-makers today is that of extending this model to the entire region, given their concern for this policy’s impacts on budgets and roads, which are already very strained by a whole range of services and usages. The potential for disseminating these practices to most of the population is currently raising many hopes on the part of operators and public-sector players but remains questionable. At the heart of the stakeholders’ concerns are questions about the economic model, the price users agree to pay for it and its impact on local government budgets.

Ever more demanding travellers

Digital technology has also made customers change: they are more connected, better informed and more demanding, which means they want to manage their time and comfort as well as possible... And yet there is a need for people to call into question their modal choices and habits and become multimodal, thus alleviating the transport system and making services sustainable. It is difficult to really discern citizens’ aspirations because they vary so much depending on the citizens’ positions in the life cycle, the places they go to, their income levels, etc. The only way to induce a change of consumption habits would be to invite people to test innovative services, reconsider their modal choices and advise/direct them to other solutions they very often do not know about or do not know how to use. This is called “mobility counselling”. The smartphone boom combined with economic difficulties mean that all industrialised countries are experiencing a “peak car use” period. Citizens are relying more and more on economical sharing solutions. In terms of day-to-day mobility, this trend is reflected in a modal shift (to more walking, cycling and use of public transport) and the separation of car usage from car ownership via car-pooling and car-sharing. These trends are expected to continue and the market for new forms of mobility should continue to grow (at a high pace, according to some people). However, today it is not so obvious that the use of cars will continue to decline at the same pace, even in densely populated areas. Mobility needs seem to be met better by private hire vehicle services (easily accessible in one click) than by self-service vehicles, the success of the Paris bike-sharing Vélib service being an exception due to the availability of many accessible and affordable bikes. The massive fleets of private hire vehicles have probably hindered the take-off of the Autolib’ car club and contributed to stifling the expansion of car sharing. But, so long as the fate of private hire vehicles and Uber is not decided, this situation is far from being static.

Towards smarter regional mobility

Digital technology has made it necessary to deeply change our system of day-to-day mobility. A market for new forms of mobility has been emerging which is not uniform: a very diverse range of offerings is available which has met with varying degrees of success with the public. Some offerings have already attained a sufficient critical mass (Vélib’, VTC, Autolib’) and are no longer at the experimental stage, whereas others are still struggling to exist (car sharing, carpooling). On the demand side, there is undeniably a positive market dynamic, which has enabled various operators and start-ups to raise funds. But all these physical services have operating deficits, a “necessary evil” in the day-to-day passenger transport sector. And yet, the usefulness of these services is unquestionable because our road and rail transport systems are under pressure. They are also essential for providing good service quality pending the completion of large-scale projects, such as the “Grand Paris Express”, which have become government priorities7. Moreover, these shared services are opportunities to test the business models of self-driving vehicles. For local public-sector players, the expectations are varied, and the challenges interconnected: attractiveness, urban marketing, financing (private rather than public), social and mobility challenges (linked with an inadequate public transport offering) and energy/environmental issues, etc. It is deemed that it would take far too long before public money could be spent on these challenges. Only experimental initiatives make it possible to test the concepts and draw up the most suitable economic models. One of the first steps towards a “smarter” region in terms of mobility would be to take the opportunity to process the numerous data sent by the applications and the ticketing to better understand demand and adapt the public transport offering by adding the required services and, if necessary, by regulating private services. The implementation of this first stage raises the issue of the quality of data exchanged between public and private players and its governance8. The other major challenge is the linkage between mobility and parking policies, which requires specific governance. Parking policies that encourage the moderate use of private vehicles would help the new mobility market to develop. Finally, although the application provides most of the advice on mobility, it seems that calling into question people’s mobility practices seems necessary to decongest roads and make for a healthier quality of life and living environment.

A massive supply of private hire vehicles

Since the law governing private hire vehicles was passed in 2009, the number of such vehicles has increased, particularly since 2013, thanks to the development of applications for smartphones. The fleet of private hire vehicles now probably exceeds the number of Paris taxis (20,000). The number of registrations with the Ministry of Transport exceeded 11,000 on 01/01/2017. As each operator may have several drivers and vehicles, the number reached 44,000 cars in April 2017, according to the Sud Taxi trade-union. In 2014, the Thévenoud report* estimated that if the Paris market were open to competition the number of taxis and private hire vehicles would reach 70,000. Given that some suppliers have been taking liberties with the law, this figure has probably already been reached. Unlike most other mobility services, private hire vehicles have achieved a critical mass. By comparison, even self-service car even Autolib car club (+/- 4,000 cars used for 11% of the time) are scarcely used. Unlike taxis, they are used more for private reasons, notably leisure (47%), rather than for professional motives. Over one third of the trips occur at night**.

*Thévenoud Thomas, « Un taxi pour l’avenir, des emplois pour la France », April 2014.

**6t-bureau de recherche, 2015, « Usages, usagers et impacts des services de transport avec chauffeur », enquête auprès des usagers de l’application Uber.

Clem and matcha multimodal offerings

Although each operator has developed a specific type of offering, some have been able to really gauge the scale of the challenges of urban mobility. These have drawn up service packages that complement their core business, i.e. car club. Thus, Clem, which operates in Marne-la-Vallée and Saclay near Paris, provides two-wheelers for rental and information on public transport facilities, as well as its car-pooling offering; while, since 2016, the Europcar group’s Matcha in the Paris Region has been offering clients the possibility of booking a private hire vehicle or a car without a chauffeur over longer periods.

Frédérique Prédali, transport urbanist, IAU îdF

1. Social and consumer observatory (ObSoCo), 2016.

2. Passenger car with driver.

3. Here, car renting and hitching respectively.

4. A series of Ademe surveys on “mobility expertise”, from 2013.

5. See Note Rapide No. 699 on car clubs and car renting in Ile-de-France (Le partage de véhicules: un marché francilien en expansion in French only).

6. Observatory of emerging mobilities Chronos/SNCF, Ademe, 2016 (survey of a sample of 4,000 people representing the population of France).

7. See the “innovation support” schemes of the Region and the Ademe.

8. Statement by French Minister of Transport Élisabeth Borne at the VivaTech show, June 2017.

This page is linked to the following category :

Economy